前言#

在上一篇文章《区块链基础知识与关键技术》里对区块链的基础知识和关键技术进行了梳理,而比特币是区块链最典型的应用,本文将对比特币核心技术进行解读,如有错漏,欢迎交流指正。

比特币系统#

比特币是在 2009 年由中本聪发明的一个数字货币,主要是为了反抗中心化的银行体系,因为其精巧的系统设计和安全性,价值也在迅速提升。同时,因为它并不与真实世界的身份绑定,具备强大的匿名性,也被用于非法交易、洗钱、勒索等恶意行为,引起了一些争议。

作为一个去中心化的区块链系统,所有人都可以访问,也可以在本地维护一个节点参与到比特币网络中,下文也会应用Bitcoin Core客户端在本地维护一个节点。

节点分为全节点和轻节点两种,早期所有的节点都是全节点,但随着数据量越来越大,运行在手机或平板等设备上的比特币客户端不需要存储整个区块链的信息,称为Simplified Payment Verification(SPV)节点,也叫轻节点。

Bitcoin Core客户端就是一个全节点,下文也会具体讲述。全节点一直在线,维护着完整的区块链信息;因为其内存里维护着完整的UTXO集合,所以通过验证整个区块链的区块和交易信息(从创世区块到最新区块)来验证交易的合法性;也会决定哪些交易会被打包到区块中;验证交易即挖矿,可以决定沿着哪条链继续挖,在出现等长的分叉时,也会选择哪一个分叉;同时监听别的矿工挖出来的区块,验证合法性。

轻节点不需要一直在线,也不需要保留整个区块链(数据量庞大),只需要保留每个区块的块头;且只需要保存与自己有关的区块,而不需要保存链上全部交易;因为并没有保存全部信息,无法验证大多数交易的合法性和网上发布的新区块的正确性,只能检验与自己有关的区块;可以通过Merkle Proof验证一笔交易存在,但不能确认一笔交易不存在;可以验证挖矿的难度,因为保存在块头中。

下面通过一个示例来讲解一下全节点和轻节点的交易验证方式。

假如要验证一个位于 block 300,000 的交易 T,全节点会查验全部 300,000 个区块(直到创世区块),建立一个完整UTXO的数据库来确保这个交易没有被花费;而轻节点则会通过Merkle Path来链接所有和交易 T 相关的区块,然后等待 300,001 至 300,006 个区块来进行确认,从而验证交易的合法性。

区块链结构#

区块链是由顺序链接起来的区块组成的一种数据结构,可以存于单文件或者数据库中,Bitcoin Client使用 Google 的LevelDB数据库存储数据。每一个区块都指向前一个区块,任何一个区块进行了修改的话,其所有后面的区块都会受到影响,所以想要篡改一个区块的话需要同时篡改之后的所有区块,这需要大量的算力,往往成本大于收益,因此极大地保障了安全性。

区块链结构包含区块Block Size (4 bytes)、Block Header、Transaction Counter(1-9 bytes)和Transaction几个核心组成部分。

区块链的块头大小为 80 bytes,存储着Version(4 bytes)、Previous Block Hash(32 bytes)、Merkle Tree Root(32 bytes)、Timestamp(4 bytes)、Difficulty Target(4 bytes)和Nonce(4 bytes)。

每一个区块的哈希值通过对区块头进行两次哈希运算,即SHA256(SHA256(Block Header)),并不存在区块链结构中,而是由每个节点接收到区块后计算得到,是独一无二的;此外,Block Height也可以作为区块的标识符。

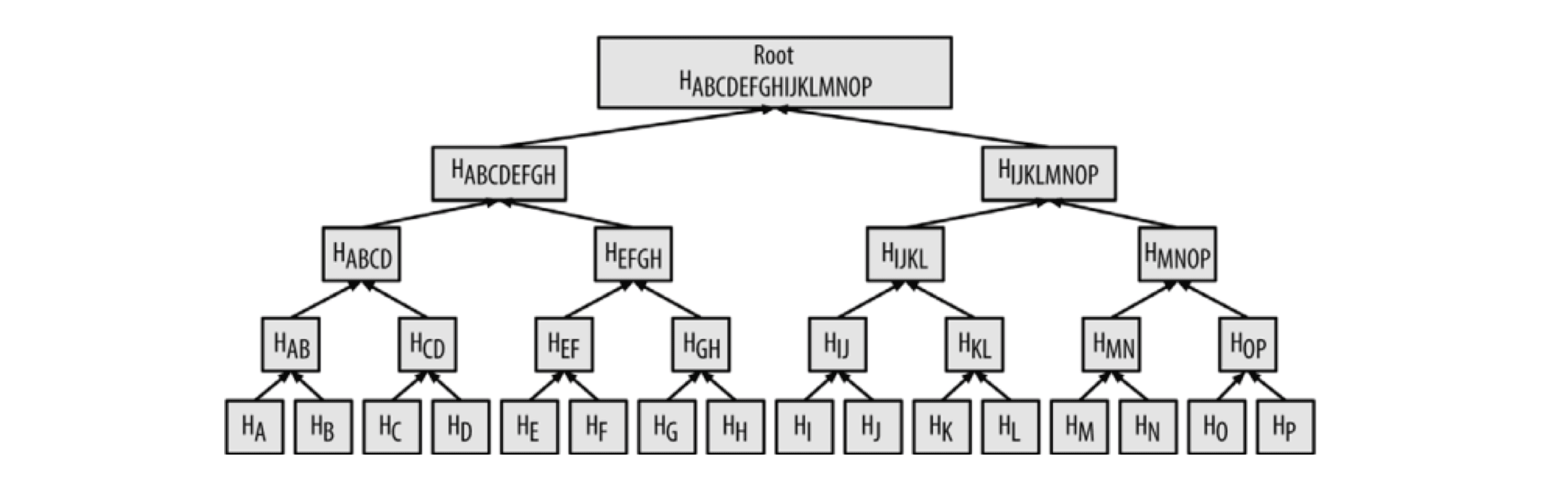

Merkle Tree#

Merkle Tree默克尔树是区块链中很重要的一个数据结构,主要通过哈希算法来验证较大数据集(也是通过双重哈希的方式SHA256(SHA256(Block Header))),结构如下图所示:

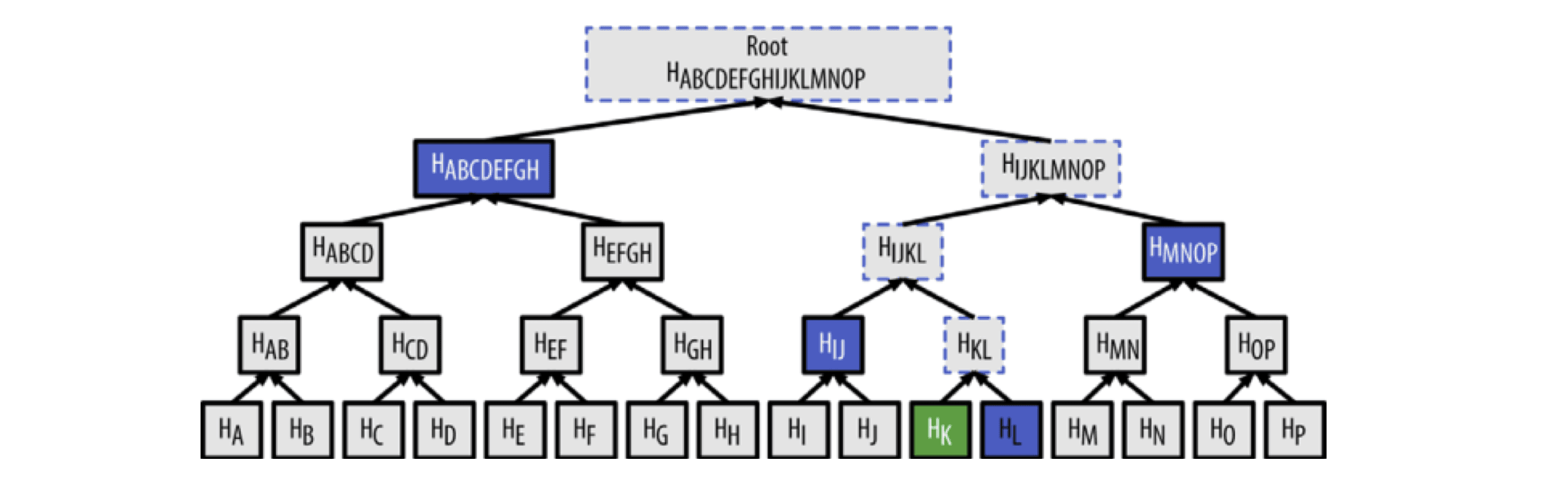

通过Merkle Tree的方式可以很快地验证一个交易存在于某个区块中(算法复杂度为LogN),例如,如果要验证一个交易 K 存在于区块中,只需要访问很少的节点

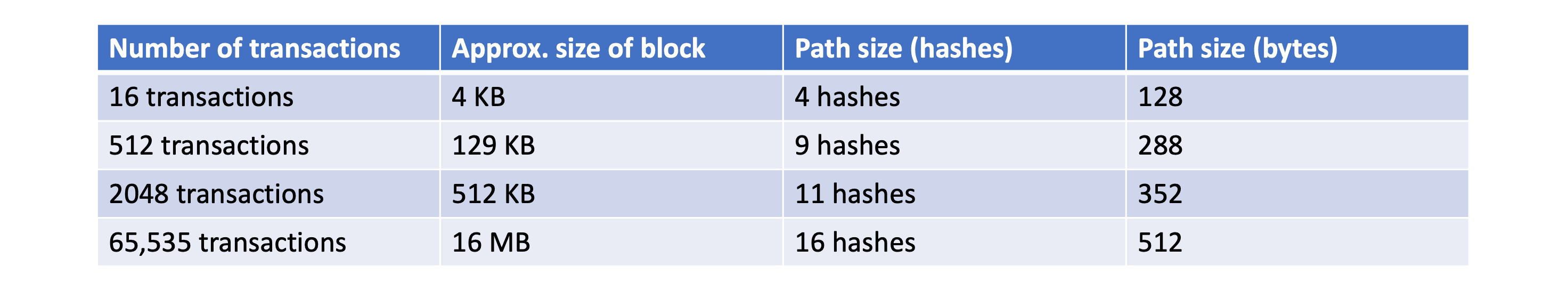

因为比特币网络中存在大量交易,这种方式能够极大提高效率,如下图所示:

因为轻节点(例如手机上的比特币钱包)不保存整个区块链数据,通过Merkle Tree结构可以很方便地查找交易,轻节点会构造一个Bloom filter布隆过滤器来得到与自身相关的交易:

- 首先,初始化布隆过滤器为空值,获取钱包中的所有地址,创建一个检索模式来匹配与这个交易输出相关的地址,将检索模式加入布隆过滤器;

- 然后布隆过滤器被发送至各个节点(通过

filterload消息); - 节点收到后会发送一个包含符合条件的区块头和符合交易的

Merkle Path的merkleblock消息和一个包含过滤结果的tx消息。

过程中,轻节点会使用Merkle Path来链接交易与区块,并通过区块头来组成区块链,从而能够验证交易存在于区块链中。

使用布隆过滤器会返回符合筛选条件的结果,也会存在着一些误报,因此返回了很多不相关的结果,也能够在轻节点向其他节点请求相关地址时保护了隐私性。

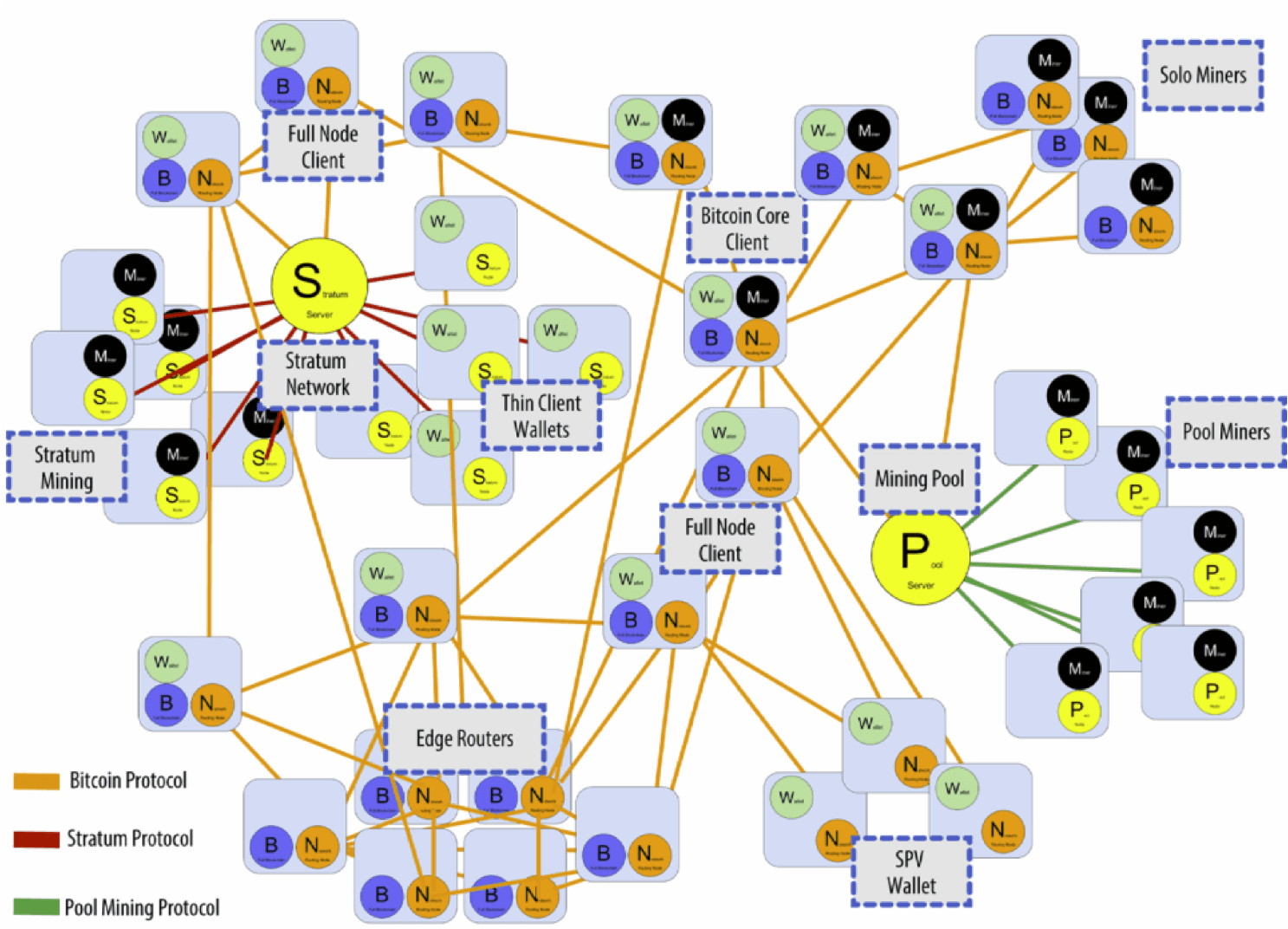

比特币网络#

比特币系统运行在一个 P2P 点对点网络上,节点之间是平等的,没有身份、权限的区别;没有中心化的服务器,网络也没有层级区分。

每个节点都要维护一个等待上链的交易的集合,每个区块大小为 1M,因此需要几秒才能够穿到大多数的节点。假设一个节点监听到了 A->B 的交易,会将其写入集合,如果同时又发现了一个 A->C 的双花攻击,则不会再写入,而如果监听到同样一笔 A->B 的交易或者同一个币来源的 A->C 的交易,则会将该集合中 A->B 的交易删除。

比特币共识协议#

比特币作为一个人人都可以参与的开发系统,需要解决恶意节点的威胁,解决思路为工作量证明机制,也就是算力投票机制,当产生一笔新交易,广播新的数据记录,全网执行共识算法,即矿工挖矿来验证记录,即求解随机数,率先解出难题的矿工获得记账权,产生新区块,然后对外广播新区块,其他节点验证通过后加至主链。

钱包#

作为一个数字货币系统,比特币有自己的钱包系统,主要由私钥、公钥和钱包地址三个部分组成。

生成钱包地址的过程如下:

- 采用

ECDSA(Elliptic Curve Digital Signature Algorithm)椭圆曲线算法,利用私钥生成对应的公钥 - 公钥很长且难以输入和记忆,因此再通过

SHA256和RIPEMD160算法得到一个公钥哈希值 - 最后再用

Base58Check进行处理,得到一个可读性较强的钱包地址

交易过程#

有了钱包(和资产)后,就可以开始交易了。我们来通过一个典型的比特币交易来理解这一流程:

A 和 B 都拥有一个比特币钱包地址(可以用 Bitcoin Client 生成,原理如上),假设 A 要给 B 转账 5 个 BTC,A 需要得到 B 的钱包地址,然后用自己的私钥对A->B转账5个BTC这笔交易签名(因为 A 的私钥仅有自己知道,所以拥有私钥则是拥有钱包资产的归属权);然后发布这笔交易,在比特币系统中发起交易需要支付小额矿工费作为交易手续费;矿工会开始验证这笔交易的合法性,得到六个确认后交易就可以被比特币账本所接受,整个验证过程大约 10 分钟。

矿工为什么要消耗大量算力来验证交易呢?

矿工在验证过程中可以得到出块奖励和矿工费,出块奖励会四年递减,因此,后期主要激励是矿工费。

为什么验证要 10 分钟呢?

比特币其实并不是绝对安全的,新交易容易受到一些恶意攻击,而通过控制挖矿难度把验证过程控制在 10 分钟左右则可以很大程度上阻止恶意攻击,这只是一种概率上的保证。

比特币系统中怎么避免双重花费呢?

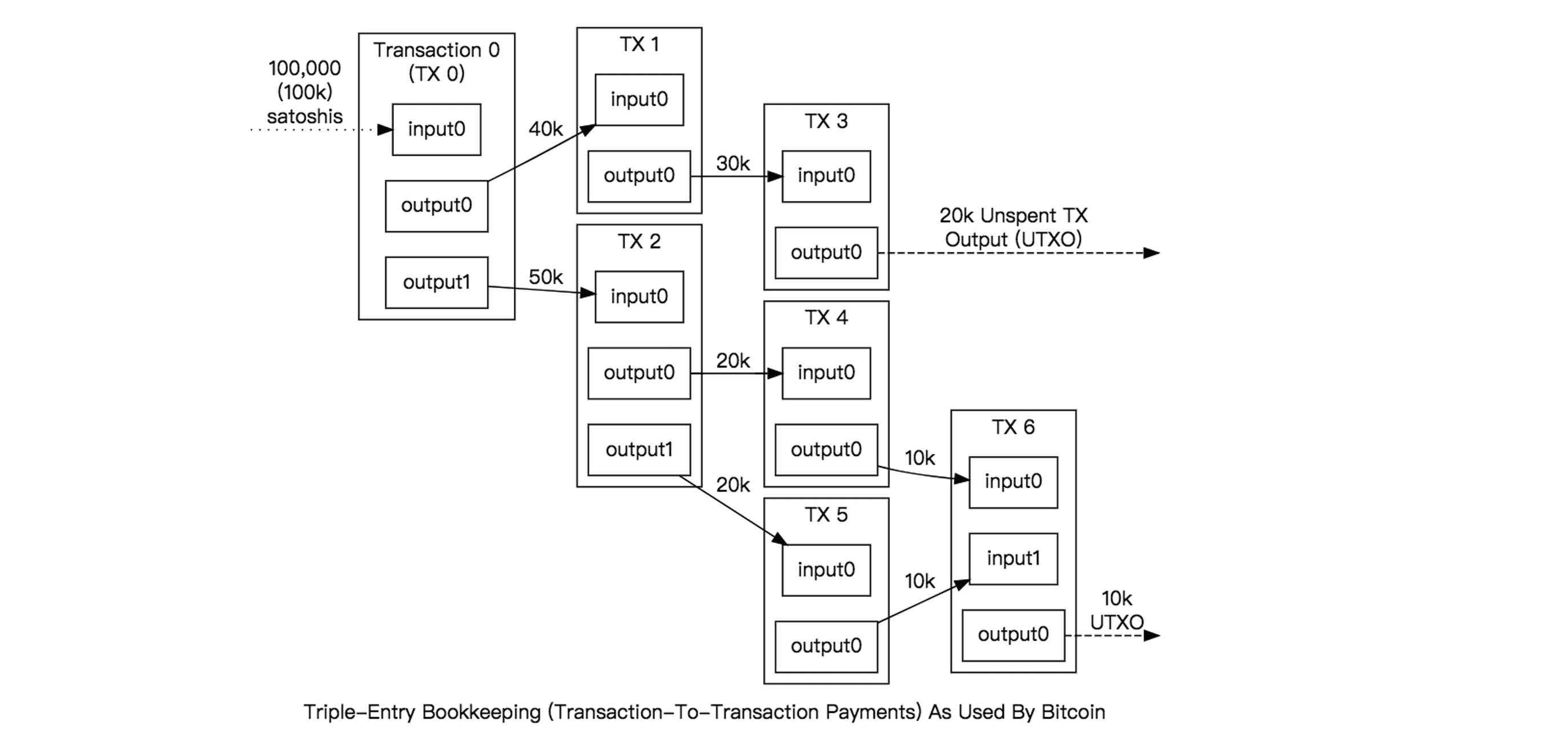

比特币采用了一种叫UTXO(Unspent Transaction Outputs)的概念,当一个用户收到一笔 BTC 交易时,会计入UTXO中。

在这个示例中,A 想要给 B 转账 5 个 BTC,A 的这 5 个 BTC 可能来自于两个UTXO(2 BTC + 3 BTC),因此 A 在转账给 B 时,矿工需要检验的是这两笔UTXO在这笔交易之前有没有被花掉,如果检测已经被花费了,则交易不合法。

下图很好地阐释了多笔交易的流向和UTXO的相关概念

此外,UTXO有一个很重要的特性,不可分割,假如 A 有 20 个 BTC,他想转账 5 个 BTC 给 B,那交易会先将 20 个 BTC 作为输入,然后产生两个输出,一个向 B 转账 5 个 BTC,一个返还给 A 剩下的 15 个 BTC,因此,A 又拥有了一笔价值为 15 BTC 的 UTXO;如果单个UTXO不够支付,则可以组合多个形成输入,但总额一定要大于交易额。

矿工怎么验证交易发起者有足够的余额呢?

这个问题看起来很简单,第一反应是像支付宝这样查询一下余额是否足够就可以。但比特币是一种基于交易的账本模式,并没有帐户概念,因此并不能直接查询余额,要想知道一个帐户的剩余资产,则需要回顾以前所有的交易,并且找到所有UTXO并相加。

交易模型#

上文讲了一个交易是怎么发生的,那比特币交易由哪些部分组成呢?

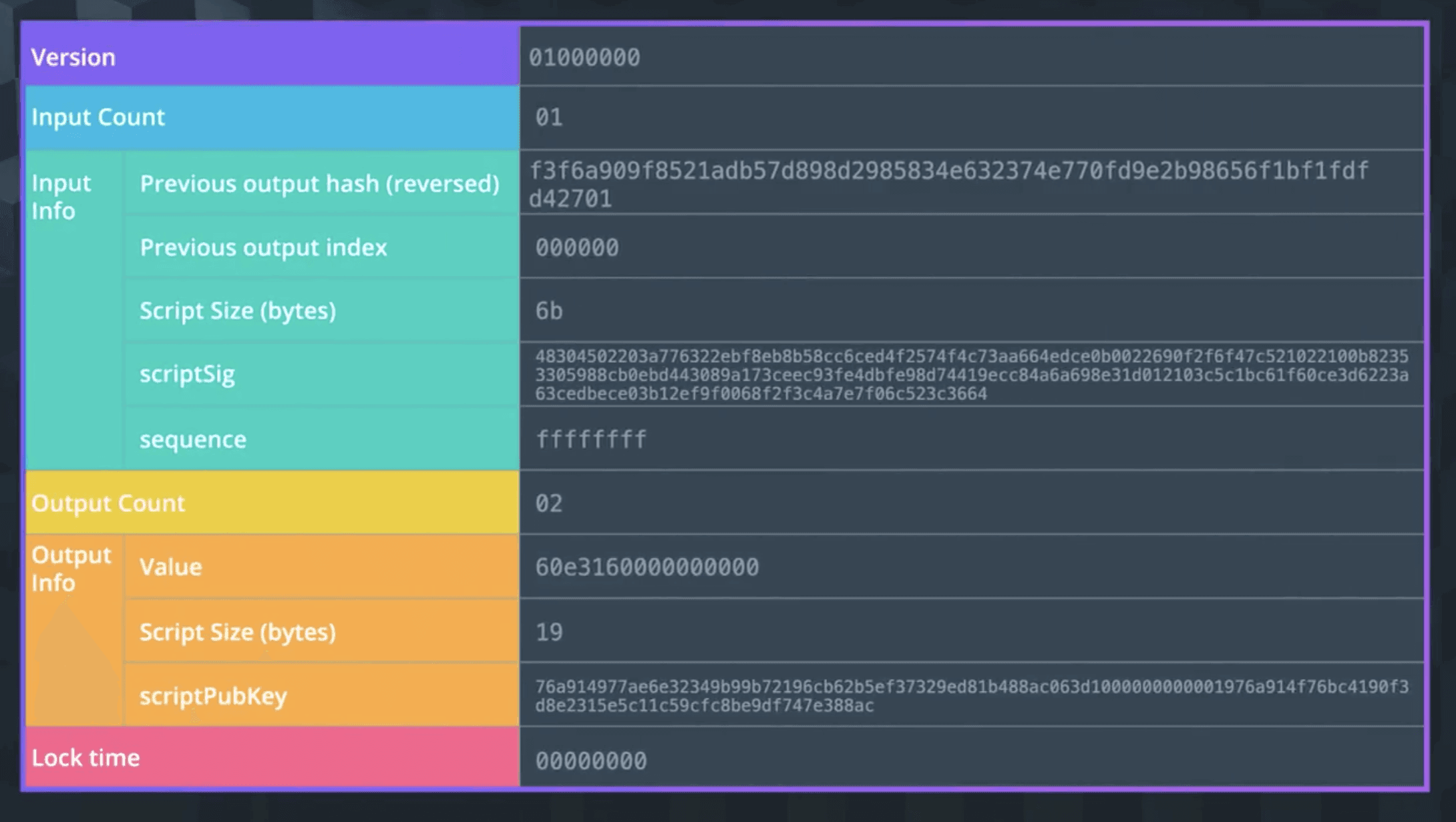

如图,最开始的部分是Version,表示版本。

然后是 Input 相关的信息:Input Count表示数量,Input Info表示输入的内容,也就是Unlocking Script,主要用于核对输入来源、输入是否可用以及其他输入的细节。

Previous output hash- 所有输入都能追溯回一个输出,这指向包含将在该输入中花费的 UTXO,该 UTXO 的哈希值在这里以相反的顺序保存Previous output index- 一个交易可以有多个由它们的索引号引用的UTXO,第一个索引是 0Unlocking Script Size-Unlocking Script的字节大小Unlocking Script- 满足UTXO Unlocking Script的哈希Sequence Number- 默认为ffffffff

接着是 Output 相关的信息,Output Count表示数量,Output Info表示输出的内容,也就是Locking Script, 主要用于记录输出了多少比特币,未来支出的条件以及输出的细节。

Amount- 以 Satoshis (最小的比特币单位) 表示的输出比特币数量,10^8 Satoshis = 1 比特币Locking Script Size- 这是 Locking Script 的字节大小Locking Script- 这是 Locking Script 的哈希,它指定了使用此输出必须满足的条件

最后是Locktime,表示一个交易可以被最早添加到区块链的时间 / 块,如果小于 500 million 的话直接读取块高度,而如果大于 500 million 则读取时间戳。

比特币脚本#

在交易中有提到Unlocking script和Locking script,那什么是比特币脚本呢?

比特币脚本是记录在每个交易中的指令列表,当脚本被执行时可以检验交易是否有效、比特币是否可以使用等。一个典型的脚本如下

<sig> <pubKey> OP_DUP OP_HASH160 <pubKeyHash> OP_EQUALVERIFY OP_CHECKSIG

比特币脚本是基于栈从左至右执行的,使用Opcodes对数据进行操作,在上面这个脚本语言中,<> 包含的是要被推入 stack 的数据,没有 <> 包括、以 OP_ 为前缀的是操作符(OP 可省略),脚本也可以嵌入数据永久记录在链上(不超过 40 bytes),所记录的数据不会影响UTXO。

在交易中,<sig> <pubKey>是Unlocking script,OP_DUP OP_HASH160 <pubKeyHash> OP_EQUALVERIFY OP_CHECKSIG部分是Locking script。

跟大多数编程语言相比,比特币脚本是非图灵完备的,没有循环或复杂的流程控制,执行起来很简单,不论在哪里执行结果都是确定性的,也不会保存状态,且脚本与脚本之间是相互独立的。因为以上特征,虽然比特币脚本相对安全,但没办法处理很复杂的逻辑,因此不适合用来处理一些复杂的业务,Ethereum所提供的智能合约就在这一点上实现了创新性的突破,因此诞生了很多去中心化应用。

挖矿#

在上文对整个交易过程中提到了挖矿,接下来我们详细讲一下。

有的节点为了得到出块奖励和矿工费,赚取收益,因此会对交易进行验证,称为矿工挖矿。出块奖励由coinbase创建,每四年会递减,从 2009 年的 25 个,到现在已经减少为 6.5 个。

挖矿其实是一个不断尝试随机数以达到某个设定目标值的过程,如小于某个 target 值,这个难度是人为设置来调整验证时间、提升安全性的,而不是解决数学难题。

矿工们会不断尝试这个值,成功率很低,但是尝试次数可以很多,因此,算力强的节点有成比例的优势,更容易解出难题。

那挖矿难度为什么要进行调整呢?

因为在比特币系统中,出块时间太短容易出现分叉,如果分叉过多则会影响系统达成共识,危害系统安全性。比特币系统通过难度调整把出块速度稳定在 10 分钟左右,从而防止交易被算改。

挖矿难度是如何调整的呢?

系统会在每产生 2016 个区块时(约两周)调整一次目标阈值,存在块头中,全网所有节点需要遵从新的难度进行挖矿,如果恶意节点不调整代码中的 target 的话,诚实的矿工则不会认可

目标阈值 = 目标阈值 * (产生 2016 个区块的实际时间 / 产生 2016 个区块的预计时间)

比特币诞生之初,矿工很少,挖矿难度也较低,大多都是用家用电脑(CPU)直接挖矿;随着越来越多的人参与到比特币生态中,挖矿的难度也越来越高,慢慢开始用一些算力较强的 GPU 进行挖矿,也有一些专用的ASIC(Application Specific Integrated circuit)专用挖矿芯片以及矿机随着市场需求逐步诞生;而现在也出现了很多大型矿池,集合了全网大量算力进行集中挖矿。

在这种大型矿池系统中,Pool Manager担任了全节点的作用,而集合的大量矿工会一起计算哈希值,最后通过工作量证明机制来分配收益。但算力过于集中容易产生一些中心化风险,如某个大型矿池达到了全网 51% 以上算力的话就可以对交易进行回滚或者对某些交易进行抵制等。

分叉#

比特币系统中,也会有未达成一致性意见的情况发生,称为分叉。分叉是主要分为两种类型,一种是状态分叉,往往是一些节点故意进行的;另一种称为协议分叉,也就是说对比特币协议产生了一些分歧。

协议分叉又可以分为两种类型,一种叫硬分叉,也就是对于协议的部分内容产生了不可兼容的修改,比如将比特币的块大小由 1M 调整为 4M,这种分叉方式是永久的,从某个节点开始形成了两条平行发展的链,比如Bitcoin Classic,形成了两种币。

另一种则叫软分叉,比如还是调整比特币的块大小,但是从 1M 调整为 0.5M,这样调整后,就会出现新节点挖小区块,旧的节点挖大的区块的情况,软分叉是非永久性的,比较典型的例子是对 coinbase 的内容进行修改以及P2SH(Pay to Script Hash)产生的分叉。

Bitcoin Core 客户端#

Bitcoin Core是比特币的实现,又被称为Bitcoin-QT或Satoshi-client,可以通过这个客户端连接至比特币网络、验证区块链、发送与接收比特币等。有Mainnet、Testnet和Regnet三个网络,可以进行切换。

提供了一个Debug Console来与比特币区块链直接进行交互,常见操作如下:

Blockchain

- getblockchaininfo: 返回有关区块链处理的各种状态信息

- getblockcount: 返回区块链中的块数

- verifychain: 验证区块链数据库

Hash

- getblockhash: 返回所提供的区块哈希值

- getnetworkhashps: 基于指定数量的最近块,返回每秒网络哈希数

- getbestblockhash: 返回最佳块的哈希值

Blocks

- getblock: 返回块信息的详细信息

- getblockheader: 返回有关区块头信息

- generate: 立即将指定数量的块挖矿到钱包中的一个地址

Wallet

- getwalletinfo: 返回一个对象,该对象包含有关钱包状态的各种信息

- listwallets: 返回当前加载的钱包列表

- walletpassphrasechange: 更改钱包密码

Mempool

- getmempoolinfo: 返回内存池活动状态的详细信息

- getrawmempool: 返回内存池中的所有交易详细信息

- getmempoolentry: 返回给定交易的内存池数据

Transaction

- getchaintxstats: 计算关于链中交易总数和速率的统计数据

- getrawtransaction: 返回原始交易数据

- listtransactions: 返回给定帐户的交易列表

Signature

- signrawtransaction: 签署原始交易的输入

- signmessage: 使用地址的私钥对信息进行签名

- dumpprivkey: 获取私钥

Network

- getnetworkinfo: 返回 P2P 网络的状态信息

- getpeerinfo: 返回每个连接网络节点的数据

- getconnectioncount: 返回节点的连接数

Mining

- getmininginfo: 返回包含挖掘相关信息的对象

- getblocktemplate: 返回构造块所需的数据

- prioritisetransaction: 以较高或较低的优先级接受交易进入挖掘的块

总结#

以上就是对比特币核心技术的一些解读,主要从它的基础原理和数据模型层面进行了一些深入了解,通过对比特币的学习,能够很好地理解区块链的设计理念和运行机制,接下来将会对被称为区块链 2.0 的以太坊进行学习和分析,敬请期待!

参考资料#

- COMP7408 Distributed Ledger and Blockchain Technology, Professor S.M. Yiu, HKU

- Udacity Blockchain Developer Nanodegree, Udacity

- 区块链技术与应用,肖臻,北京大学

- 区块链技术进阶与实战,蔡亮 李启雷 梁秀波,浙江大学 | 趣链科技